Houthis, We’ve Got A Problem.

Back in October of last year, I wrote a long-form piece on the Hamas attack on Israel, and in it, I wondered whether the conflict would expand beyond Gaza, and if so, where and how? At the time, my best guess was across Israel’s northern border and into southern Lebanon, the home turf of Iran-backed Hezbollah. I didn’t set any sort of timeframe for when I thought things might kick off there, though now, roughly 100 days later, the time seems to be drawing ever nearer.

One thing I’ll own up to not having foreseen is the current conflict in the Red Sea. There’s a number of reasons why it doesn’t really make sense to me, and I’ll list some of them out here as a series of observations.

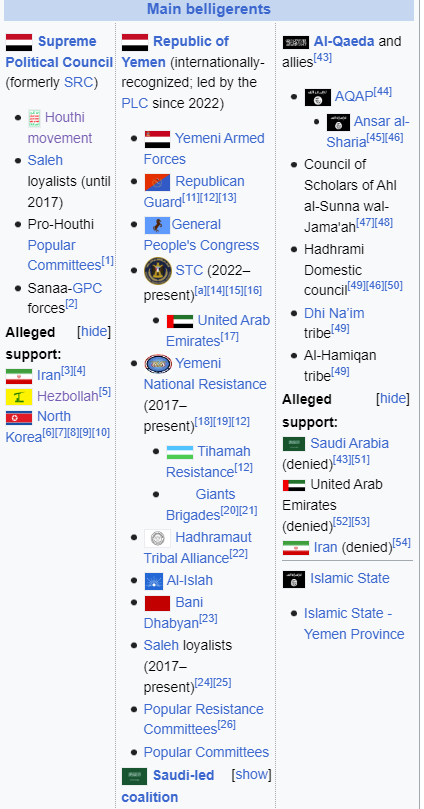

Yemen is complicated. And sure, all of the Middle East is complicated, but Yemen’s recent political history takes that sort of complication to a whole different level. If you’re hesitant about believing me, just have a look at this chart of the main belligerents in Yemen’s ongoing civil war:

The Yemeni civil war has given rise to an incredibly dire humanitarian situation within the country. In order to facilitate aid, in February 2021, the US State Department lifted the designations of the Houthis (who control a significant portion of the country’s territory) as a Foreign Terrorist Organization (“FTO”) and a Specially Designated Global Terrorist (“SDGT”). The objective was to enable global aid organizations to deliver relief without fear of violating US laws against providing assistance to FTOs. I wondered, mostly to myself, at the time whether lifting the SDGT designation was truly necessary to accomplish this, but it happened.

Clarifying note here (and I’m going to vastly oversimplify, so wonks, try not to freak out): We’ve heard it said that providing material support to a terrorist is a crime under US law. And that’s true…for FTO-designated terrorists. The SDGT designation doesn’t bar that sort of conduct. The SDGT designation, on its own, allows the Treasury Department to take action to disrupt the terrorist’s finances / interaction with the global financial system.

Following their attacks on commercial vessels transiting the Red Sea, and their subsequent attacks on US Navy ships patrolling the area, the Houthis have been re-designated as SDGT, though not as FTO. The Biden administration may change their tune on the FTO designation at any time, however. In many ways, the SDGT hopscotch is evidence of failed efforts to bring the Houthis to the diplomatic table. With Iran really pulling the strings behind the Houthis, though, it’s not immediately clear to me why anyone thought the “carrot” approach would have worked back in 2021.

For Iran, Yemen represents the perfect trap. Given the humanitarian situation in Gaza as a result of Israel’s operations in response to the October 7 attacks, the US has very little appetite to be accused of worsening the humanitarian crisis in Yemen by redesignating the Houthis as an FTO. So, the US is forced to confront the Houthi threat without the benefit of one of its strongest anti-terrorist weapons: economic resource denial.

I’ve wondered, from time to time, why groups like the Houthis agree to be Iran’s proxies—and missile fodder—in their “cold war” against America, Israel and the west generally. Much like the original Cold War, I think it’s fair to chalk most of it up to ideology. And for the Houthis, a hatred of the United States, and of Israel, have been a day-one tenet.

Iranian support of a disruption of commercial shipping traffic in the Red Sea strikes me as kind of nuts. By now, I think everyone understands how vitally important Red Sea transit—leading up to the Suez Canal and into the Mediterranean—is for international trade. We’ve seen images of the huge container ships making the transit, full of goods from Asia, off to be sold in Europe, and the EMEA region more broadly. And who’s the single-biggest manufacturer of goods in Asia? That’s right, it’s China—the very same China that happens to also be the single biggest purchaser of Iranian oil. Now, I’m no customer service expert, but putting a top client’s commercial interests at risk maybe isn’t the best way to do business, and Chinese firms have already started to feel the sting of drastically more expensive, and delayed, shipping to Europe. Given the recent reports we’ve read of cooling in the Chinese manufacturing sector, I can’t imagine the Red Sea crisis is welcome news in Beijing. I’d imagine that this sentiment will soon be communicated to Tehran, if it hasn’t been already.

Counterintuitive as it might be, the Red Sea crisis has actually added to the valuations of various global shipping companies responsible for transiting goods through the region. That…doesn’t seem right, and yet it is! Let’s do some microeconomics: i) there’s a crisis in the Red Sea, where vessels keep getting attacked; ii) insurance costs for vessels transiting the Red Sea skyrocket; iii) shipping companies decide it’s more economical to avoid the Red Sea—and thus also those skyrocketed insurance costs—by taking the long way to Europe around the Cape of Good Hope; iv) this new route keeps ships occupied for longer, which therefore decreases their availability (i.e., the “supply” of seafaring shipping from Asia to Europe); v) decreased supply means increased price, and the valuations of shipping companies rise. So, to recap, in this little scenario, decreased efficiency leads to increased enterprise value. Did the Houthis just turn shipping companies into…law firms?

That’s all I’ve got for now. I have a few things I could say about the military conflict, but they’ve already been said by loads of other people by now. This’ll be ongoing, low-intensity, and indulgent of Iran’s fig leaf that it’s not truly the one behind the entire mess currently engulfing the Middle East.

If you want more on this subject, I’d start with this analysis from the Atlantic Council.

Good Wall Hunting: A Carta Story.

Not everyone here knows what Carta is, so indulge me for a minute while I explain:

When you have a startup—or any private company really—you need to have what’s called a “capitalization table,” or “cap table,” for short. A cap table is a list of all of the owners of equity in the company, typically divided up by equity class, ranked by ownership stake, etc. As these companies grow, undergo financing events, etc., these tables can become more and more complicated. Wouldn’t it be great to have a piece of web-based software that could help companies manage these tables, issue stock certificates, and all that jazz? Enter, Carta. And it was good.

But eventually, Carta wanted to be something else, too. It wanted to help facilitate trading in private company stock, because trading stuff makes money. More to the point, it likely makes a heck of a lot more money than what amounts to a fancy spreadsheet app (which, if you recall, is Carta’s main line of business). And startup insiders want to sell their stock sometimes, so this is great for them too. Just a great big win all around, right?

Not quite.

To really get into the problem here, we need to explore a *problematically named* term commonly used in the financial services industry: the “Chinese wall.” Named after the Great Wall of China, or those interior screen-walls found in Chinese historical design, depending on whom you ask, a Chinese wall in the finance context amounts to an information barrier between different units of a financial services business in order to prevent conflicts of interest. We could call it an “ethics wall,” if you will. In the most common financial services context, the wall divides information access between investment banking and sales and trading business units within a large bank. The investment banking unit might have in its possession certain confidential and proprietary information about a company for the purpose of conducting, say, a debt offering for the company. Traders on the bank’s fixed income desk, whose clients might be large hedge funds trading in the company’s debt, would love to have a peek at that information for the purpose of informing their selling and trading activities. But that would be unethical and wrong, obviously. And, under Title V of the Sarbanes-Oxley Act, it’s also illegal.

But what if we’re not talking about an investment banking unit and a sales and trading unit, but rather, a fancy spreadsheet unit and a sales and trading unit? What then?

Things blew up for Carta around a week and a half ago, when a plucky employee on the equity sales side of Carta contacted an investor of a company (called “Linear”) using Carta’s cap table management services to inform them that Carta had a buyer for the investor’s shares, should they be willing to sell. But how did that employee know that the investor they called was a holder of shares in Linear? By a quick peek over Carta’s apparently porous (or non-existent?) Chinese wall, of course! Linear’s CEO caught wind of this and publicly disclosed the issue on social media, postulating the ethics breach, and all hell rightfully broke loose.

Less than a week later, Carta announced that it would be shutting down its stock sale business. And man, was that intervening week full of wild internet behavior. This whole thread really encapsulates the dialogue between the CEOs of Linear and Carta, serving as sort of a “what not to do” of corporate communications, from Carta’s end. But this also isn’t the only recent mess Carta’s been in, and I wonder if the firm’s rickety ethical walls won’t be the undoing of its entire house.

Quick Hits

China’s Cracked Apple’s AirDrop Encryption — I’m not sure what to say here really except “totalitarianism blorp.” I mean, AirDrop has always sort of creeped me out as a feature to begin with. Like why do I want a big virtual inbox taped to my back while I’m out in public? But hey, if you’re an anti-government activist, AirDrop might be a pretty useful way to get the word out. And if you’re an anti-government activist in China, I’m assuming that you’re fully aware that the MSS is doing everything it can to track you, stop you, etc. So, no more AirDropping. I’m sure that, for the activists, there’s other tools at their disposal. The real question here is: what is Apple going to do about it?

India vs. Apple — With respect to Apple’s brushes with totalitarian conduct, we can’t just let China have all the fun, can we? Of course not. *Modi has entered the chat,* as it were. Apparently, hackers on behalf of the ruling BJP (Modi’s party) tried to hack the iPhones of various journalists and opposition politicians. Apple caught wind of the hacks and alerted those folks. Rather than offering categorical denials and slinking away into the shadows, the Modi government actually went on the offensive against Apple, announcing an investigation into what they allege are faults in the company’s device security. The gall! It’s a strategy so brazen, it’s almost impressive. It’s not difficult to believe that the Modi government is, indeed, guilty of phone hacking. Numerous watchdogs, NGOs, and media outlets have reported finding evidence of Indian government hacking upon forensic analysis of phones belonging to individuals critical of Modi or his allies. But trying to strong-arm Apple into going along with the scheme by retracting its warnings about hacking, etc., is as stupid as it is shocking, particularly as India tries to court Apple’s manufacturing business away from longtime rival China. For Apple, this can’t feel great, as it seems to have traded one totalitarian government for another, or, at the very least, one that’s trying its best to be so. Will this cause Apple to rethink its planned manufacturing investments in India? Maybe. But then, where to next? Malaysia? Vietnam? Central / Eastern Europe? Somewhere in Cupertino, a deck is being made.

New York Moves To Ban Non-Compete Agreements — This stuff about non-competes annoys me, but of course it would; I’m a lawyer who mostly represents companies. I write non-compete clauses on a fairly regular basis. But I also genuinely think they’re important for the purpose of protecting critical intellectual property, trade secrets and other sensitive commercial information. But who am I kidding, it’s not as though departing employees actually take sensitive information with them out the door in order to share it with competitors / subsequent employers, right? Oh, wait.

Bird Explodes — Thankfully, this story isn’t about a literal bird, but rather, a scooter company. But man, is it depressing. For one, it’s another case of a SPAC that went down the tubes, but it’s a whole lot darker than many of the others. Ultimately, I think the “personal mobility rental” business, when deployed on the street vs. via brick-and-mortar rental locations, is something best left to municipalities. In New York, for instance, CitiBike has worked. The shops near central park that rent scooters also work. But just leaving scooters out on the street for people to rent with an app, hoping they don’t get stolen, and relying on independent contractors to round them up by seemingly any means necessary when they do get stolen? Who even gave these people money to try something like that? Oh that’s right, SPAC investors.